All Categories

Featured

Table of Contents

Degree term life insurance policy is a policy that lasts a collection term normally in between 10 and thirty years and features a degree fatality benefit and degree costs that remain the exact same for the entire time the plan is in impact. This indicates you'll recognize specifically just how much your repayments are and when you'll have to make them, allowing you to spending plan accordingly.

Level term can be a wonderful alternative if you're wanting to acquire life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance Barometer Study, 30% of all grownups in the united state requirement life insurance and don't have any kind of policy yet. Level term life is foreseeable and economical, that makes it one of the most preferred sorts of life insurance.

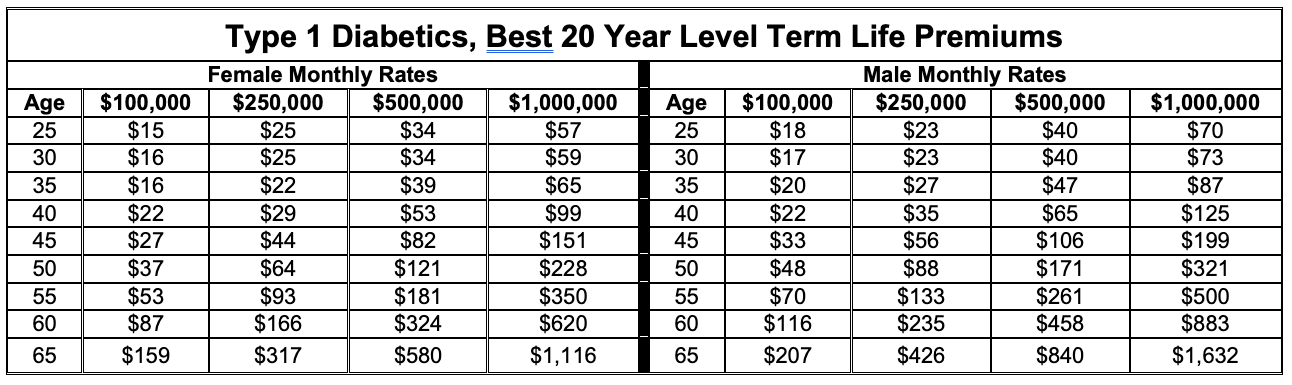

A 30-year-old male with a similar profile can anticipate to pay $29 monthly for the exact same coverage. AgeGender$250,000 coverage quantity$500,000 protection quantity$1 million protection amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Technique: Ordinary monthly rates are calculated for male and female non-smokers in a Preferred health category obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy.

Rates may differ by insurance firm, term, coverage quantity, health and wellness course, and state. Not all plans are offered in all states. Rate illustration legitimate since 09/01/2024. It's the cheapest type of life insurance for many people. Level term life is much a lot more affordable than a comparable whole life insurance policy policy. It's easy to take care of.

It allows you to budget plan and prepare for the future. You can conveniently factor your life insurance policy into your budget plan because the premiums never alter. You can plan for the future just as quickly since you know specifically just how much money your loved ones will get in the event of your lack.

Is Annual Renewable Term Life Insurance a Good Option for You?

This is real for people who stopped cigarette smoking or who have a wellness condition that resolves. In these cases, you'll usually have to go via a brand-new application procedure to get a far better rate. If you still require coverage by the time your level term life plan nears the expiry date, you have a couple of alternatives.

Many level term life insurance plans include the choice to restore protection on a yearly basis after the first term ends. The cost of your plan will be based on your present age and it'll boost each year. This might be an excellent choice if you only require to expand your insurance coverage for a couple of years otherwise, it can obtain expensive quite quickly.

Degree term life insurance policy is just one of the cheapest coverage alternatives on the marketplace since it offers basic defense in the type of fatality benefit and just lasts for a collection amount of time. At the end of the term, it runs out. Entire life insurance, on the other hand, is considerably a lot more costly than degree term life due to the fact that it doesn't expire and features a money worth attribute.

Prices might differ by insurer, term, insurance coverage quantity, health and wellness class, and state. Not all policies are available in all states. Price illustration valid as of 10/01/2024. Degree term is a fantastic life insurance policy alternative for most people, yet depending on your protection needs and individual circumstance, it might not be the very best fit for you.

This can be a great alternative if you, for example, have simply stop smoking and require to wait two or 3 years to apply for a degree term policy and be qualified for a reduced rate.

, your death benefit payment will certainly decrease over time, however your repayments will certainly remain the exact same. On the other hand, you'll pay even more in advance for much less protection with a raising term life plan than with a degree term life policy. If you're not certain which type of plan is best for you, working with an independent broker can assist.

As soon as you have actually determined that level term is best for you, the following step is to buy your plan. Below's exactly how to do it. Compute how much life insurance policy you need Your protection amount ought to attend to your family members's lasting economic needs, including the loss of your revenue in the event of your death, in addition to debts and daily expenses.

One of the most preferred type is now 20-year term. A lot of business will not offer term insurance coverage to a candidate for a term that ends previous his or her 80th birthday. If a policy is "eco-friendly," that means it proceeds in force for an extra term or terms, up to a defined age, even if the health and wellness of the insured (or other factors) would certainly cause him or her to be rejected if he or she used for a brand-new life insurance policy policy.

Premiums for 5-year renewable term can be level for 5 years, then to a brand-new price reflecting the brand-new age of the insured, and so on every five years. Some longer term plans will certainly assure that the costs will not raise during the term; others do not make that assurance, making it possible for the insurance provider to increase the rate throughout the plan's term.

Why You Should Consider Direct Term Life Insurance Meaning

This implies that the policy's proprietor deserves to transform it into an irreversible kind of life insurance without extra proof of insurability. In many sorts of term insurance, consisting of property owners and automobile insurance coverage, if you have not had a claim under the policy by the time it expires, you obtain no refund of the costs.

Some term life insurance policy consumers have actually been dissatisfied at this result, so some insurers have produced term life with a "return of costs" feature. The premiums for the insurance coverage with this feature are usually considerably more than for policies without it, and they usually need that you keep the plan in force to its term otherwise you waive the return of costs benefit.

Degree term life insurance policy costs and fatality advantages stay constant throughout the policy term. Level term policies can last for durations such as 10, 15, 20 or three decades. Degree term life insurance policy is commonly much more affordable as it does not develop cash money worth. Level term life insurance policy is one of the most typical kinds of protection.

While the names frequently are made use of reciprocally, degree term protection has some important distinctions: the costs and death advantage stay the very same for the duration of coverage. Degree term is a life insurance policy policy where the life insurance policy costs and fatality advantage remain the same for the period of insurance coverage.

Table of Contents

Latest Posts

Burial Insurance Life

Life Insurance For Burial Costs

Funeral Insurance Reviews

More

Latest Posts

Burial Insurance Life

Life Insurance For Burial Costs

Funeral Insurance Reviews